As World Cup fever has finally descended on England, I’ve found myself becoming more patriotic by the day. Now it isn’t just Harry Kane’s beautiful penalty technique that is getting me excited, but also the fantastic startup ecosystem that has been developing around us for the last decade.

The Perfect Storm

Now this subtitle isn’t a subtle reference to London’s weather, but rather a combination of factors that have successfully reduced the barriers to entry to the UK markets. No more have we seen this exemplified but in Financial Services, where FinTech/InsurTech/WealthTech (etc) startups have genuinely been able to get to market and achieve tangible scale, competing with, or effectively working with their incumbent counterparts.

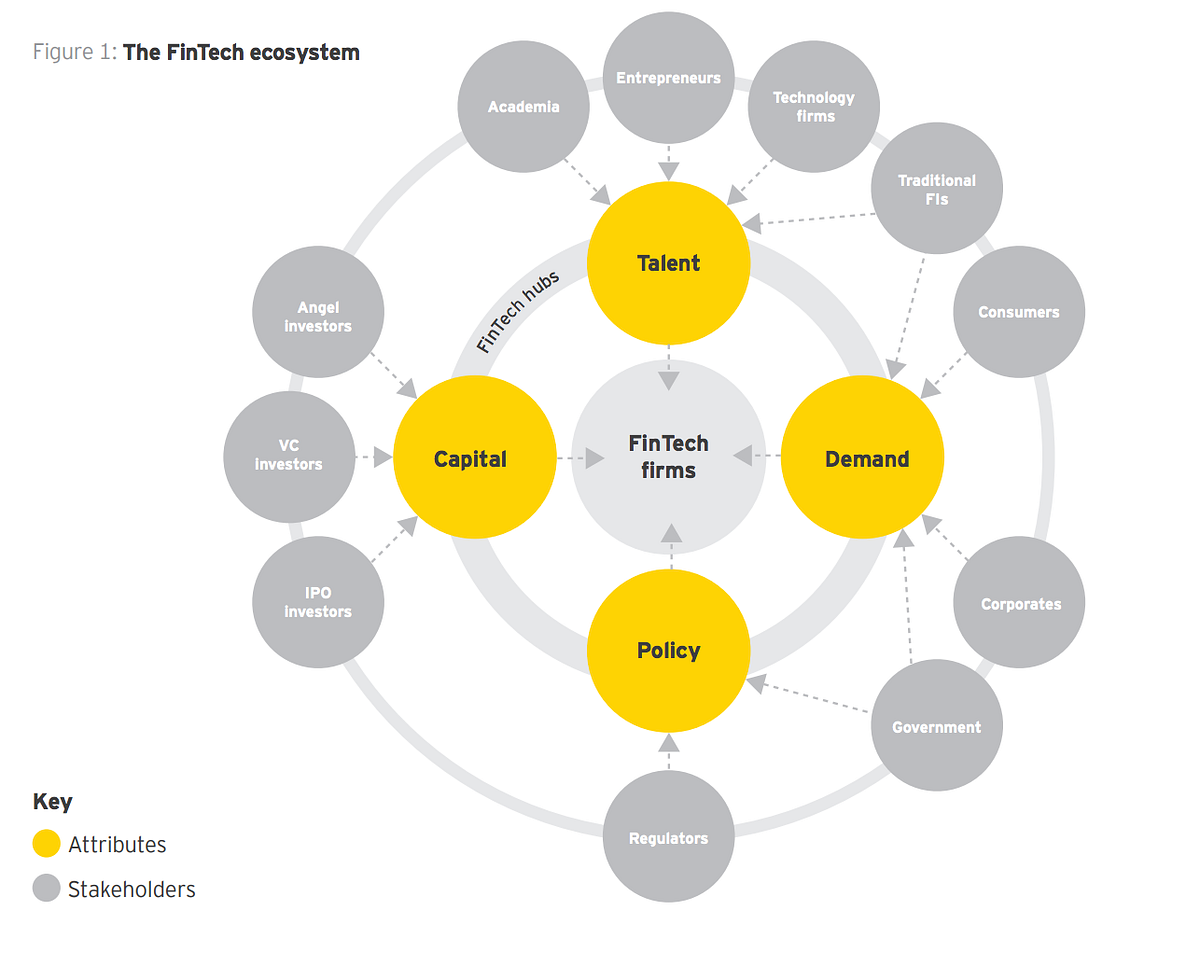

I looked at these attributes in detail a few years ago, whilst at EY for HM Treasury, and believe they remain the same and have only intensified since. We reported at the time, that an ecosystem should be judged through four key attributes:

- Talent

- Capital

- Policy

- Demand

Although this framework has a broader application to all sectors that technology is disrupting/enabling, I’m going to choose to focus on Financial Services, as I believe this is where the UK truly has the opportunity to, and already does, differentiate.

So has the UK ecosystem improved?

1. Talent

The UK has always been a world center for Financial Services’ business, and as long as in a post-Brexit environment we retain the HQ of big incumbents such as HSBC and a-like, then we will continue to hold onto and produce some of the most experienced Financial Services’ talent.

Whilst the current availability of tech talent in the UK is sufficient, there has been a move to outsource to near-shore developer teams. That said, kudos to HM Treasury and the Tech Nation initiative, who are being very progressive with immigration initiatives to attract the world’s best talent into the country.

2. Capital

We all read the reports saying global FinTech/InsurTech investment is increasing year-on-year, and whilst the bulk of investment into InsurTech was in the US, last year saw c.$742m invested across Europe, of which c.$364m was invested in the UK, up from c.$19m the previous year (Accenture, 2018).

The UK has had the fastest growing capital inflow of any geography into InsurTech in the last two years.

Now the key isn’t the cumulative investment value, but at what stages of the capital curve investment is going into. The UK continues to try and encourage early stage investment through tax incentive schemes such as the Seed Enterprise Investment Scheme (SEIS), but there remains a lack of Super Angels making repeat investments or have a willingness to take big punts on new ideas and technology. Is it just because the British are more risk-adverse than the Americans?

The UK has always had a restrained growth capital provision, but is going to change. The government is clearly keen to drive investment into startups in the UK, with £2.5bn British Patient Capital Programme announced last week; consequently we will start to see the rise of larger/bigger UK-based funds over the coming years to support the growth of our best startups.

3. Policy

We continue to have the strongest policy environment globally, with a government and a regulator who are both looking to support the ecosystem by enabling new business models. The Financial Conduct Authority’s (FCA) Sandbox has gone from strength to strength; now looking at building international ‘FinTech Bridges’ and a global Sandbox. Certainly the latter, will hopefully allow UK-based startups to easily internationalise and quickly scale across multiple global markets. Further, last year the FCA regulated the InsurTech Gateway (*plug*); this was the first time globally that an investment vehicle has been regulated for anything other than investment purpose.

HM Treasury is also doing a great job to support locations outside of London, with a growing tech presence in, for instance, the ‘Northern Powerhouse’ Manchester with local grants. Further there are now new funds, such as Accelerated Digital Ventures, with a sole focus on startups based outside of London. My personal view is this can only be a good thing for the country, but that said, one of Silicon’s Valley’s winning traits is its concentration of different ecosystem attributes.

4. Demand

Is anyone actually using this ‘shit’?

When was the last time you used a FinTech? Within the last 6 months? Monzo? Revolut? I’d like to pride myself as being an early adopter, but I genuinely believe that FinTech has now hit the mass market. For example, when was the last time you gave cash to someone that you owed money too, rather than transfer via your phone in a few clicks?!

The UK consumer market is debatably as mature as it gets when it comes to understanding and using financial products.

Further, consumer engagement is ever-increasing, and with Science, Technology, Engineering and Mathematics (STEM) education now being commonplace in the school curriculum, i’d hope that us Brits will be even more financial literate over the next decade. As Mary Meeker recently highlighted in her infamous annual ‘Internet Trends’ report, it is often forgotten, [but] Europe right now is graduating hundreds of thousands more STEM graduates per year than the United States. At the PhD level, we are graduating 35,000 to 40,000 more per year.

And lest we forget that we are all addicted to our phones already…

Creating a natural secondaries market

So is London, and the UK, finally competing with Silicon Valley & the US to generate the world’s best startups?

Not quite yet…

The key factor that the UK lacks on, as I alluded to above, is access to very early stage (I.e. Angel) capital. We are yet to see enough IPOs and trade exits to create a new wave of Super-Angels who are willing to then write cheques, and start the funding journey of the next generation of startups in the UK. I think of this as a natural secondaries market if you will…

Funding Circle, one of the most notable UK ‘unicorns’ (a tech firm with a valuation north of £1bn), is the latest firm to make headlines for a soon-expected IPO. Many other notable digital lending platforms such as Zopa and LendInvest as well as banking challengers such as Monzo have also dropped hints that they aspire to move into public spheres eventually, if not soon.

Despite the uncertainty around the ongoing Brexit negotiations, a potential trade war between the US and China and rumoured interest rate rises, Europe’s IPO market remains open for business. The outlook for 2018 is promising as issuers continue to be attracted to the UK market with a number of cross-border IPOs set to launch in London. The London Stock Exchange remains the number one exchange in Europe by volume, although IPO proceeds are down €0.7bn (PWC, 2018). So could we start to see startup IPOs and more sales over the coming years?

Whether or not Founders of UK-HQ’d startups choose to cash out in the UK, or elsewhere, one would hope that they would look to their home country to reinvest their personal newly-made wealth.

So where’s the UK sign-up sheet?

The UK is clearly a great place to start any business, and in particular a FinTech or InsurTech one at that. So as the UK becomes increasingly attractive, we are starting to see the emergence of new ‘micro-VC’/seed/first-time funds crop up across town to plug that very funding gap.

One such option is the Insurtech Gateway, which not only offers early stage seed investment to startups, but also a range of capabilities from regulatory cover, to underwriting capacity and a platform of further support to enable any entrepreneur to take a great idea to market. Check out our Founders tab for more information. We are actively looking for opportunities to import foreign ideas and startups into the UK market, as well as of course home-grown ideas.

ps. Also don’t forget that of course….football is coming home…

#barmyarmy