It has been a busy month for FloodFlash with their return from a trade mission to the US and their ongoing role in the Lloyd’s Lab. Clearly not a company to stay still, the team have also just announced a product update that will make parametric flood cover even more flexible.

In this blog, we dig into how and why they are upgrading their groundbreaking flood cover.

“Multi-trigger policies represent another big step in making parametric insurance more affordable and flexible. This is a really important development, requested by customers, that means we can protect even more livelihoods”

Adam Rimmer, co-founder

Why has FloodFlash updated their product?

Event-based insurance has many advantages over traditional indemnity cover. FloodFlash is a real example of the potential this new insurance product has to offer. Business owners and landlords across Britain are already learning the benefits like faster payouts, fairer prices and more flexible cover. However, there is one key question that often arises when discussing the concept: “what happens if a customer misses my trigger event?”

To combat this perceived shortcoming of parametric insurance, FloodFlash have introduced policies with multiple trigger points. Their clients now have access to cover that has multiple trigger depths, so a flood of 0.48m could have triggered smaller payouts at 0.2, 0.3 and 0.4m — meaning there is less concern that the 0.5m trigger depth did not lead to a payout.

When did FloodFlash launch multi-trigger policies?

Multi-trigger policies have been available as standard from the beginning of September.

How are multi-trigger policies so effective?

Creating policies with multiple trigger points may seem like more effort when a customer could choose cover at a lower trigger level. However, according to FloodFlash there are many benefits that make that extra effort worthwhile:

- Multi-trigger quotes are cheaper

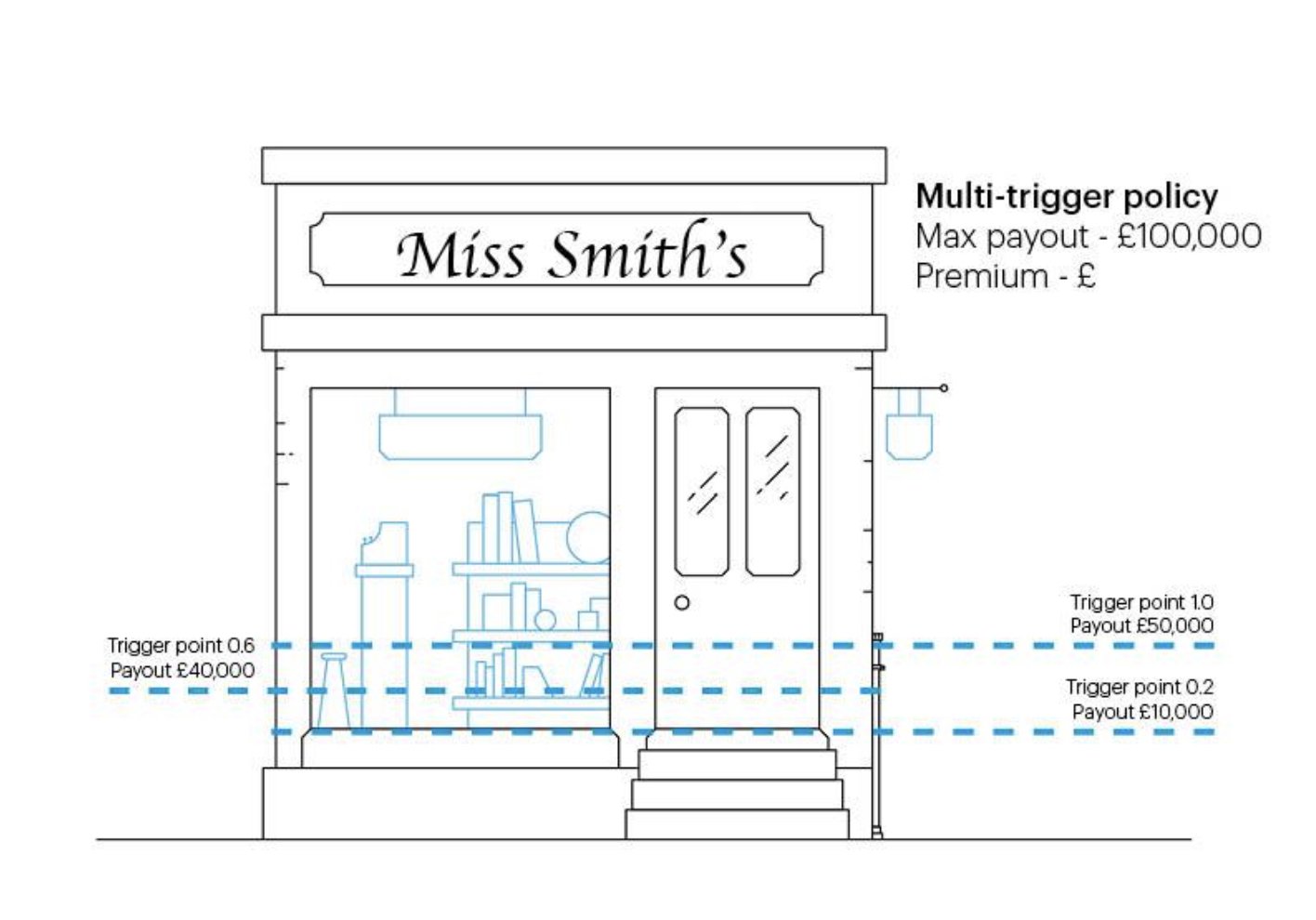

To demonstrate how multi-trigger policies are cheaper, FloodFlash have shared an example closely based on real customer conversations. In the example, Miss Smith operates an independent retailer whose main flood concerns are clean-up, stock replacement, and paying wages for when the shop is out of action. Her shop flooded previously to a depth of around 1.0m, requiring a payout of £100,000.

With a single-trigger policy, she would select a payout amount of £100,000 at 0.2m. This would ensure that she has the same level of cover, and that a payout occurs for a lower level flood. However, this leads to a large premium.

Single-trigger policy: large payout amounts at lower depths can inflate the premium amount and make quotes expensive

With the new multi-trigger option from FloodFlash there is a better option. Given her requirements, Miss Smith can now request the following trigger depths and payout amounts:

- a payout of £10,000 at 0.2m

- a payout of £40,000 at 0.6m

- a payout of £50,000 at 1.0m

This quote still has the maximum payout of £100,000 if a 1.0m flood were to happen, but she receives small amounts of the total at different depths. If we share the payouts across different depths of flooding the cover becomes much more efficient. By removing unnecessary payouts that aren’t required for low level flooding and adding them to higher trigger depths we can offer Miss Smith a much more competitive price — and she still has the cover her business needs when larger floods happen.

Multi-trigger policy: spreading a total payout across multiple triggers can have a significant impact in lowering premiums

Multi-trigger policies are more flexible

Smart sensor: a multi-trigger policy still only uses one FloodFlash sensor, so there are no additional costs to worry about

This may seem like an obvious point, but the flexibility of multi-trigger policies is important for businesses that want bespoke cover. FloodFlash customers can now choose up to five different trigger depths, each with a corresponding payout amount.

Multi-trigger cover helps avoid fear of missing out

Finally, and going back to the limitations of parametric insurance, multi-trigger policies mean that there is a lower fear of missing out on a payment. Knowing that you have multiple payout options and that regardless of the final flood levels, a payout is available for lower to medium flooding helps ensure that clients are prepared to recover from every scale of flood event.

How do I apply for a FloodFlash multi-trigger policy?

Multi-trigger quotes now come as standard for any FloodFlash customer. If you want to find out more about FloodFlash rapid-payout insurance or you want to apply for cover for your business or commercial property visit www.floodflash.co or refer your broker.