Guest blog by Benjamin Hay, COO and Co-Founder, Collective Benefits.

Now more than ever it’s important to fight for better benefits and protections for the self-employed.

The gig-economy was once considered to be the future of work. No longer. Covid-19 has highlighted societies increasing dependence on the self-employed. With the pandemic keeping people indoors, on-demand workers are more visible than ever. Yet the essential services provided by this flexible workforce extends far beyond delivery, logistics and courier services. With hospitals under increasing pressure, we have also seen the NHS turn to digital staff banks to fill urgent temporary vacancies and maintain staffing levels.

Yet this crisis has also highlighted the widening protection gap for the self-employed.

96% of whom have no income protection, translating to over 5.8 million people in the UK alone.

In a recent survey, 71% of self-employed saying they are not able to benefit from the government’s Self Employed Income Support Scheme and 88% of those eligible couldn’t wait until June for payment.

Furthermore, research by The Sunday Times found that over three million people were not eligible for anything but universal credit during this crisis as they are newly self-employed, zero-hour contractors or sole directors of limited companies.

Against this backdrop, it is no wonder that we have been overwhelmed with enquiries from self-employed looking for protections and a safety net. Simply, they need a financial safety net now.

At Collective Benefits, we are on a mission to fix this.

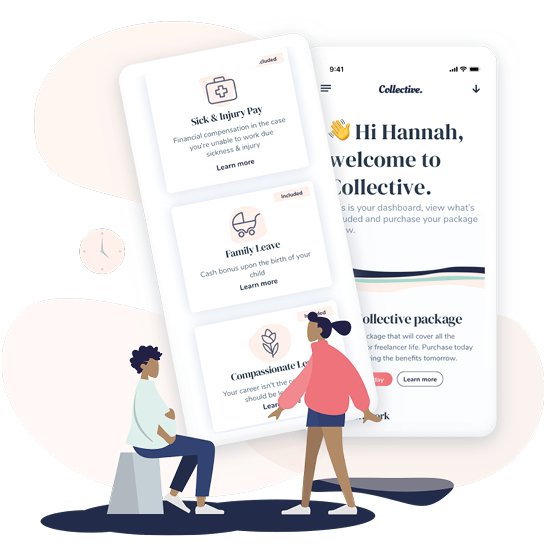

We’re building the first benefits platform for the self-employed including income protection products like sick pay and family leave alongside a range of other insurance products, services and benefits all designed for on-demand workers.

In order to play our part, we accelerated the launch of our direct to consumer beta programme (by about 9 months!) to give freelancers direct access to our benefits and protections like sick pay so they can get the support and cover they need right now. Additionally, we have also teamed up with the UK fintech and freelancer community to lobby for clearer and faster income support for the self-employed.

Ultimately, we need a longer-term solution to this protection gap. A solution which we believe is best provided by partnering with forward-thinking gig-economy companies and marketplaces so that they can provide the benefits and protections their self-employed workers need and deserve. It can cost these businesses less than a price of a cup of coffee per month to give workers an essential safety-net and all of which is accessible through our tech-platform.

It’s not just the right thing to do – there is a clear business case.

In providing benefits for their self-employed workforces, our partners have seen a decrease in recruitment costs, decrease in worker churn and an increase in overall worker engagement.

As the coronavirus pandemic continues and the vulnerability of millions of self-employed workers is laid bare, we believe the companies and platforms who actively seek to protect their workforces through troubling times will benefit the most in the long term.

The conversation about benefits for the gig-economy is at an important turning point. We have an opportunity to reinvent and reimagine the safety-net, not just through temporary government measures but sustainably over the long term. Let’s ensure that the self-employed get the safety net they need and deserve.

About

Benjamin Hay is COO and Co-Founder of Collective Benefits, a former barrister that focussed on large scale public inquiries like the 7/7 terror attack and is ex-leadership team at Virgin Unite, Sir Richard Branson’s entrepreneurial foundation.

Collective is an Insurtech Gateway backed insurtech platform offering tailored insurance products and benefits for the self-employed like sick pay, family leave, and mental health support. Collective partners with companies helping them boost loyalty, reduce churn and talent acquisition costs by giving their self-employed workforces the protections and benefits they want and need.

If you have an idea for a social impact insurtech we would love to hear from you. Please get in touch to find out how we can accelerate your business or incubate your idea.