Our insurtech portfolio

The Insurtech Gateway portfolio has a strong ideology. Our founders know tech and insurance combined has the potential to change the world we live in for the better.

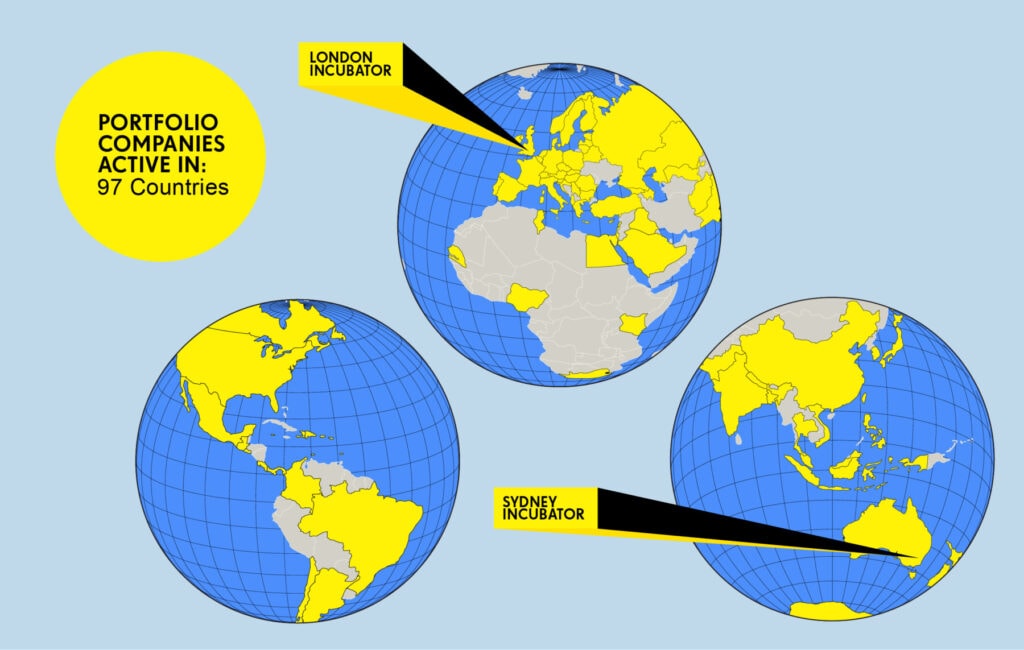

Over the last seven years the portfolio has grown, made many partnerships and launched products all over the world.

The number of world firsts is testimony to creative thinking, breakthrough technologies and what can be achieved by ‘free-range’ entrepreneurs in a supportive innovation environment.