Bondaval

Your word. Our bond.

THE SMARTEST WAY TO COVER CREDIT RISK

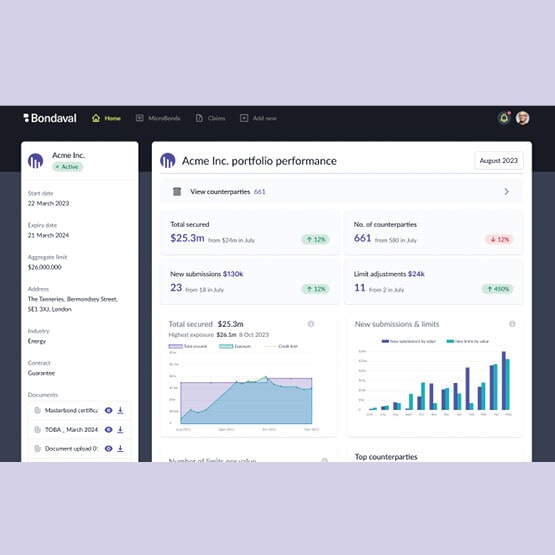

Credit managers seeking to cover their exposure to their buyers have so far been stuck with a small range of analogue, imperfect tools. Bondaval‘s technology-enabled insurance products are able to replace any of these tools in one place, while offering more complete, flexible cover, all delivered through the Bondaval platform.

Powered by Bondaval proprietary data engine, risks can be underwritten at scale, while feeding insights back to both insurers and credit managers.

Insurtech Gateway led their $1.64m Pre-Seed round in January 2021, following on when they raised a $7m Seed round in October 2021 and $15m Series A in December 2022.

PROBLEM

Securing credit risk either involves significant balance sheet impact for the counterparties being covered, or uncertainty on the part of the beneficiary seeking cover. Existing solutions from banks and traditional credit insurers are often slow, opaque, and cover can be cancelled with little warning.

SOLUTION

Bondaval’s range of products combine more complete, A-rated cover with a powerful technology platform to give credit managers more transparency and control over the risk they are covering, while releasing the constraints on counterparties posting security.

BONDAVAL FOUNDERS

Tom Powell (CEO) – 5 years experience with surety-related products. 2 years working in an early-stage tech venture. 1 year working at a Bio-Tech start-up. Prior to business, Tom was a professional sportsman and England captain in 2 Commonwealth Games and Rugby Sevens World Cup.

Sam Damoussi (COO) – 10 years experience as a surety and growth specialist in insurance-backed bonds. Established and launched two prior A-rated, fuel bond programs both as MGA and insurer. Previously at an independent Lloyds broker and CNA.

“Without the support of Insurtech Gateway, there might not have been a Bondaval. By sponsoring us as an Appointed Representative under their FCA license, Insurtech Gateway gave us the regulatory support we needed to start operating immediately: the equivalent of a two-year head start. Now, their guidance has helped us to navigate the process and become directly authorised with the FCA ourselves. They have been invaluable champions of the business, and their continued support is greatly appreciated.”

Tom Powell, CEO at Bondaval

BondAval Secures $1.64m Pre-Seed

We are delighted to welcome BondAval to the Insurtech Gateway portfolio, leading their $1.64m Pre-Seed investment round, alongside True Sight …

BondAval partners with Hamilton and Beat

BondAval has entered into a partnership with Hamilton Insurance Group and Beat Capital Insurance Services, to provide MicroBonds™ to the …

Bondaval Raises $15 Million Series A

$15 million Series A Bondaval’s technology-enabled MicroBonds provide certainty of cover on receivables to FTSE 100 and S&P 500 multinationals, …

“Bondaval’s digitised product is making life so much easier and efficient for Retailers to secure credit from their Wholesalers and Suppliers. It has been a pleasure working with Tom, Sam and the Bondaval team to launch their proposition in Europe and the US.”

Robert Lumley, Co-Founder at Insurtech Gateway