Jumpstart

Jumpstart, earthquake insurance

BUILDING RESILIENCE

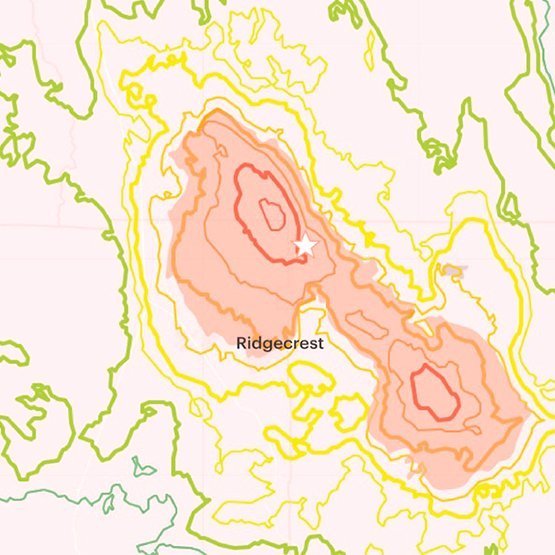

Jumpstart earthquake insurance is event triggered, super fast, lump-sum payouts, for catastrophic events – starting with Earthquakes in California.

Building community resilience to natural disasters, by providing affordable coverage that gives instant lump-sum payouts with no deductible, is at the heart of Jumpstart’s mission.

Insurtech Gateway incubated Jumpstart in October 2018. They were acquired by Neptune in October 2021.

JUMPSTART FOUNDER

Kate Stillwell (CEO) – Kate has 10 years experience as a practicing structural engineer and 7 years in earthquake risk modelling. She was also Founding Executive Director of the Global Earthquake Model Foundation (GEM).

PROBLEM

Less than 10% of California state’s 12.5m households hold quake insurance.

Incumbents’ products are perceived as overly-complex, opaque and slow.

SOLUTION

Customers pay a low monthly premium. If their insured location experiences the parametric trigger, Jumpstart will deposit a lump sum of $10,000, right away, no strings attached, straight to their bank account.

“Natural hazards are only the beginning. The change we want to see in the world is for index-based ‘parametric’ insurance to become so widespread that ‘Jumpstart policy’ becomes a generic term for any coverage with fast, fixed payouts. The current premiums for CA EQ are $600 million. Jumpstart aims to double this while expanding to other earthquake-prone states and other perils”

Kate Stillwell, Founder at Jumpstart

Natural Disaster Resilience Report

More than two in five Americans worry about their community in a natural disaster Nearly three in five Californians impacted …

San Francisco Business Times: Jumpstart

Bay Area residents aren’t prepared for the next earthquake. This startup wants to change that “Kate Stillwell doesn’t want to …

Willis Towers Watson: Parametric Case Studies

“In this edition of the Quarterly InsurTech Briefing, we look at event-based, or “parametric,” insurance offerings and ask ourselves whether …